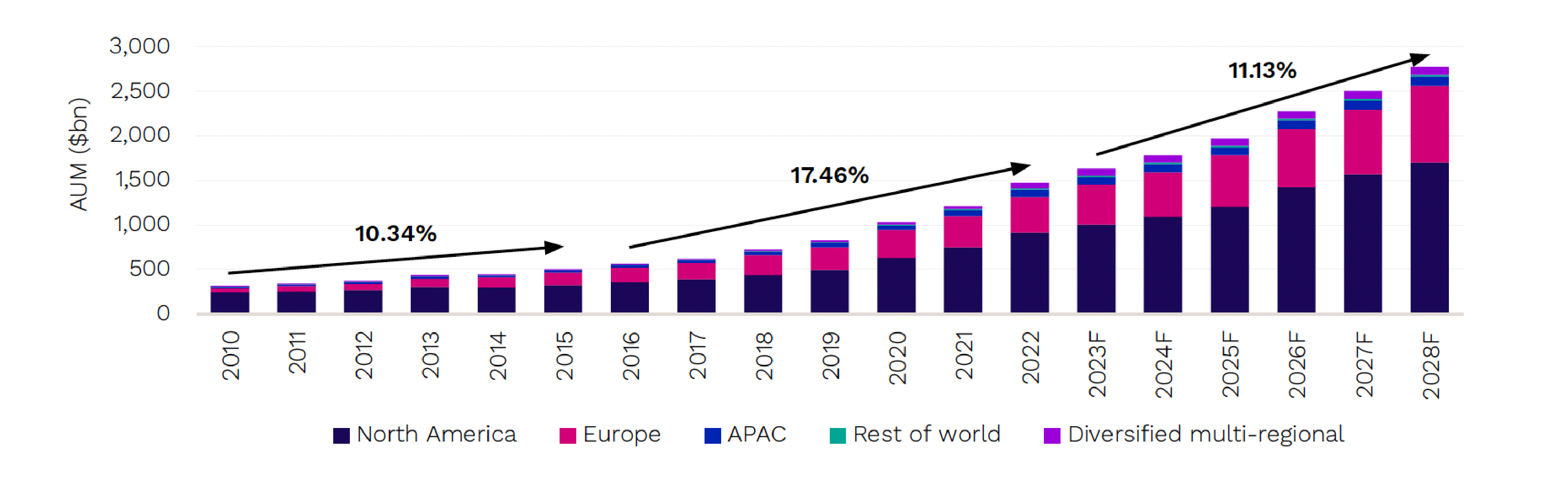

Private credit assets under management (AUM) continued to be on the rise in 2023 – with strong deployments in the APAC and ROW regions driving a 4% increase in overall market share. This follows the tailwinds in the sector provided by elevated base rates seen throughout the period. Due to the slow downward transmission in rates from the banking sector to SMEs, this trend is likely to continue through 2024.

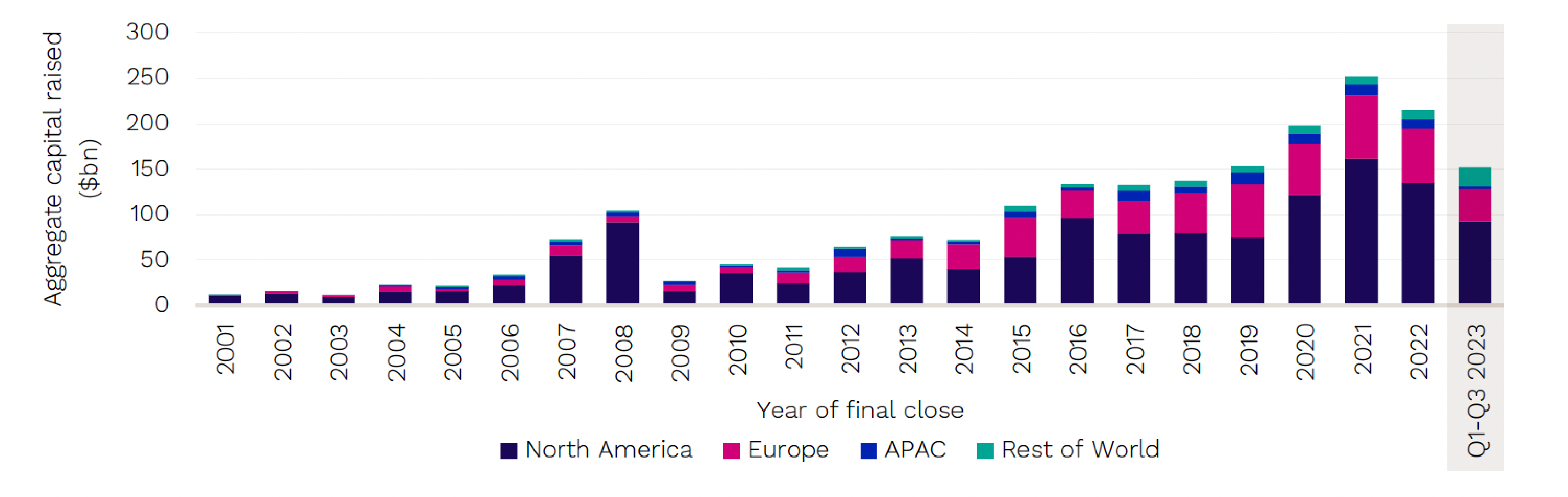

Fundraising by private debt funds closed by primary geographic focus

Source: Preqin Pro

According to Preqin Pro, fundraising by private debt funds closed by primary geographic focus is expected to grow at an 11% CAGR over the next four years, mainly in North America and Europe, which account for ~57% of SME lending by institutional and alternative lenders. This is not surprising given the increased exposure to these regions where SME lending originates from institutional and alternative lenders.

Private debt allocations growth to be driven by increased APAC & ROW deployment strategies

Source: Preqin Pro *AUM figures exclude funds denominated in Yuan Renminbi

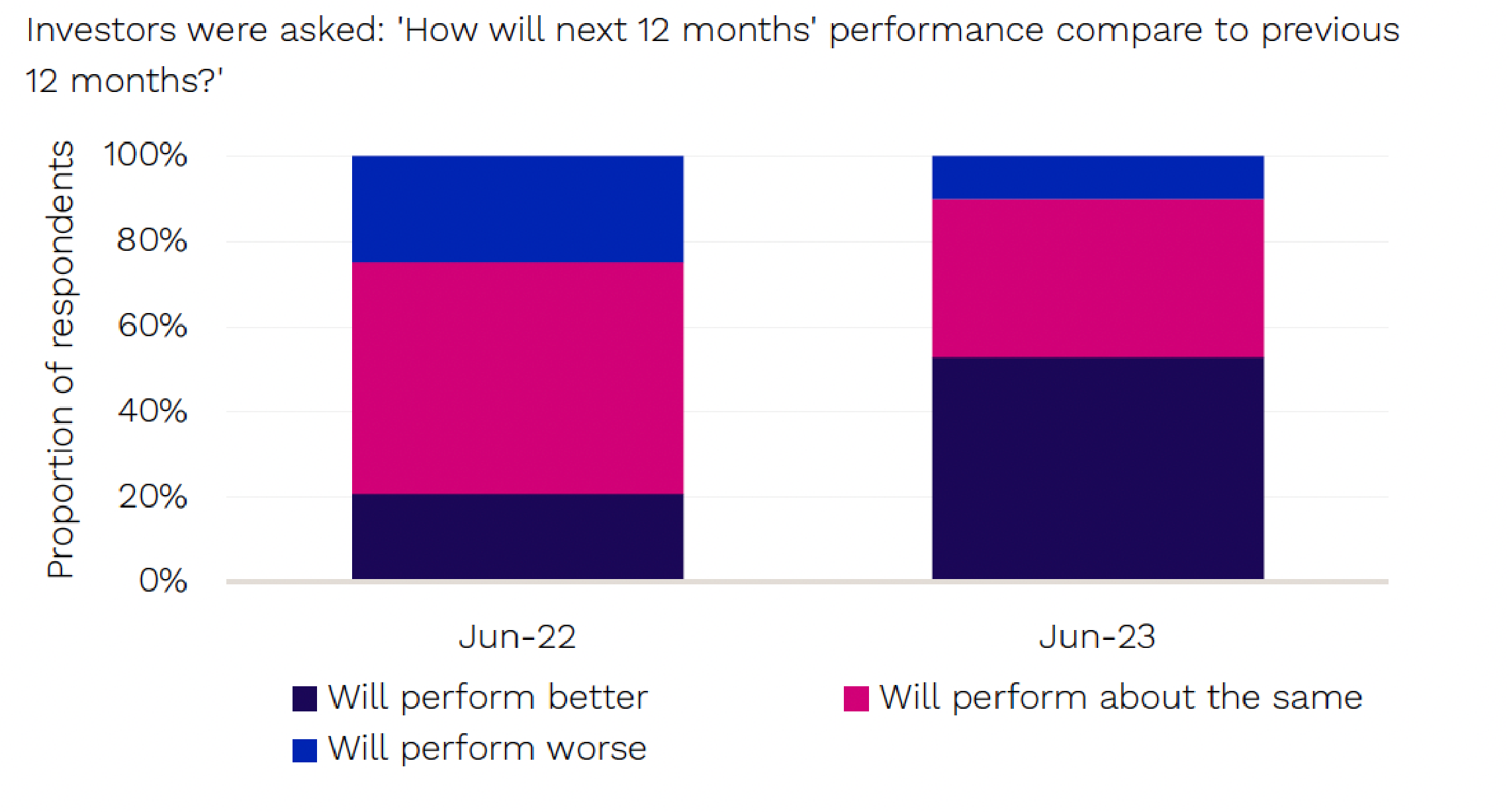

This is validated in investor sentiment towards the asset class – with inflation stabilising and yields remaining elevated, return expectations have recalibrated to expect higher returns in private debt that should translate to increased deployment.

Higher confidence in return expectations from lower volatility of inflation

Source: Preqin Investor Surveys, June 2022 – 2023

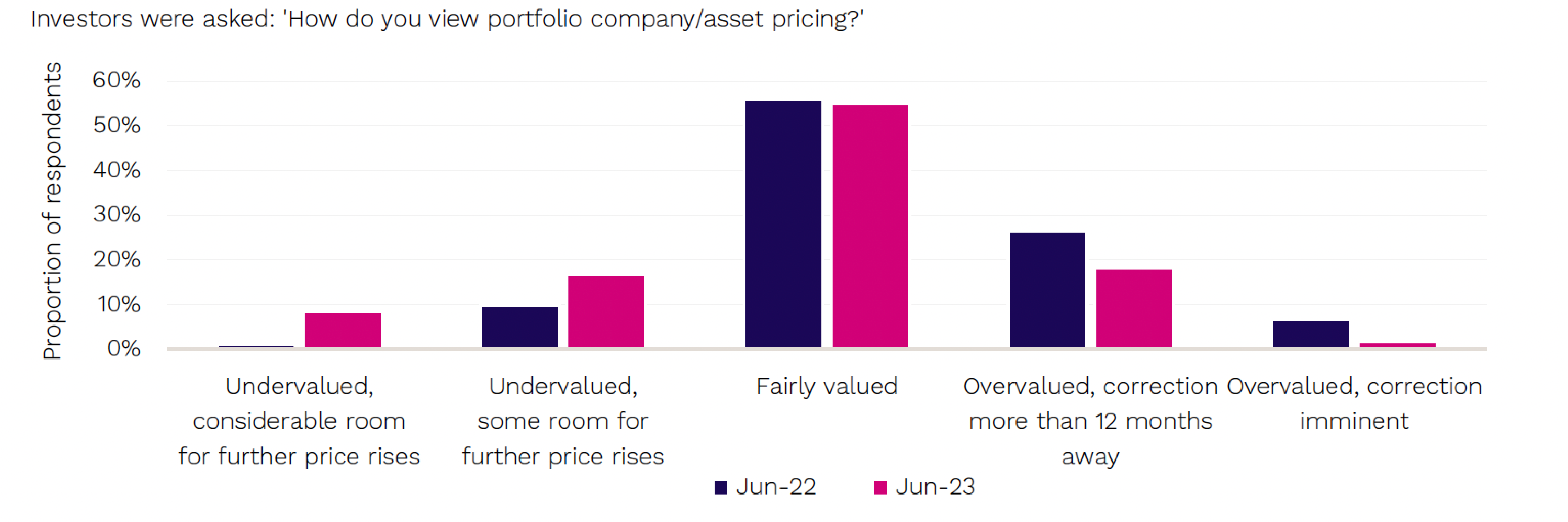

Finally, perception of value from investors towards private debt strategy target companies has recalibrated to a majority view that there is value in the market – which paired with the sentiment and deployment strategies above, should drive allocations towards the asset class over the next 12 months.

Higher proportion of investors see value in the market as against 2022

Source: Preqin Investor Surveys, June 2022 – 2023

Key Takeaways

-

Private credit assets under management (AUM) rose 4% in 2023, driven by strong investments in the APAC and ROW regions. -

This growth follows increased base rates, expected to continue into 2024 due to slow rate transmission to SMEs. -

Fundraising by private debt funds is set to grow at an 11% CAGR over the next four years, mainly in North America and Europe, which account for ~57% of SME lending by institutional and alternative lenders. -

Investor sentiment is positive, with expectations of higher returns from private debt due to stabilized inflation and high yields. -

The value perception towards private debt strategy target companies has improved, suggesting increased allocations to the asset class in the next 12 months.

The rise in private credit assets, driven by strong investments in key regions and positive investor sentiment towards higher returns and value perception, offers investors potential for increased returns and diversification benefits in their portfolios.

Any questions?

Book a call with our Investor Relations team here

If you require more information, contact us at [email protected]