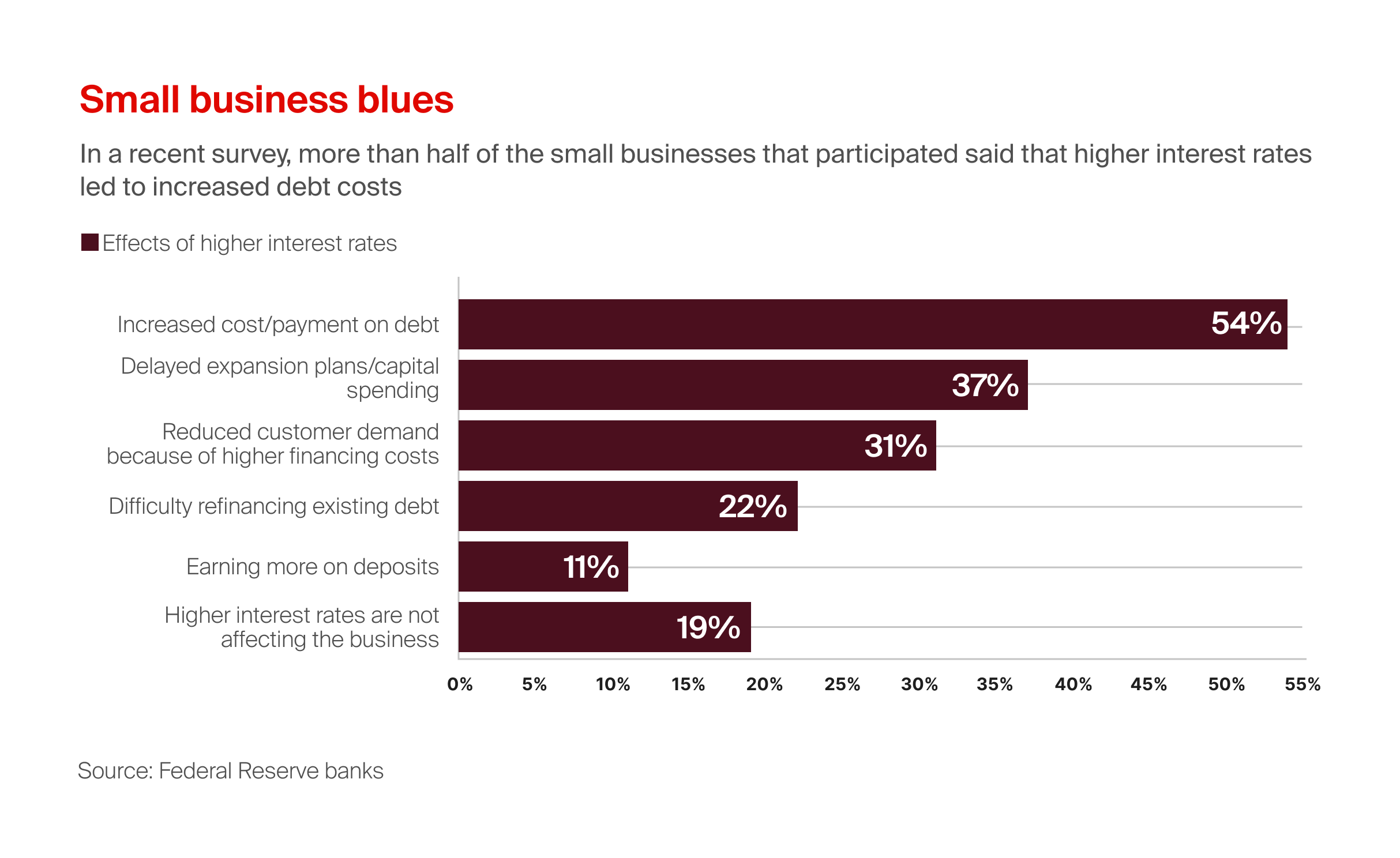

For over a year, the “higher-for-longer” theme has dominated markets, referring to persistently high interest rates. High borrowing costs and inflation make managing cash flow difficult for businesses that now have higher debt payments, which in turn delays expansion plans and capital expenditures. Many are having difficulty refinancing their existing debt.

SMEs have two main challenges. It’s generally harder for them to negotiate around prices, and they lack experience with budgeting, planning, and implementing a risk management framework.

Many small business owners feel that if the rates were lower, they would seek out credit to expand. Based on a recent survey by the Federal Reserve banks, this graph illustrates the effect of higher interest rates on small businesses. More than half of the respondents (54%) reported increased costs or payments on debt as a major effect. Other significant impacts include delayed expansion plans or capital spending (37%), reduced customer demand due to higher financing costs (31%), and difficulty refinancing existing debt (22%). A smaller percentage of businesses (11%) reported earning more on deposits, while 19% indicated that higher interest rates are not affecting their business.

Federal Reserve’s Strategic Interventions to Stabilize Financial Institutions

In response to the financial difficulties faced by several lending institutions, such as Silvergate Bank and Silicon Valley Bank (SVB), the Federal Reserve has intervened to provide stability. These interventions included providing emergency funding, guaranteeing deposits, and facilitating mergers to prevent these institutions from collapsing. By doing so, the Fed aimed to maintain confidence in the banking system, protect depositors, and prevent a wider financial crisis. This support is crucial as it ensures that the banking sector, which carries a significant portion of the debt refinancing burden, remains stable and capable of supporting the economy through lending and financial services.

The Peak of Active Investing

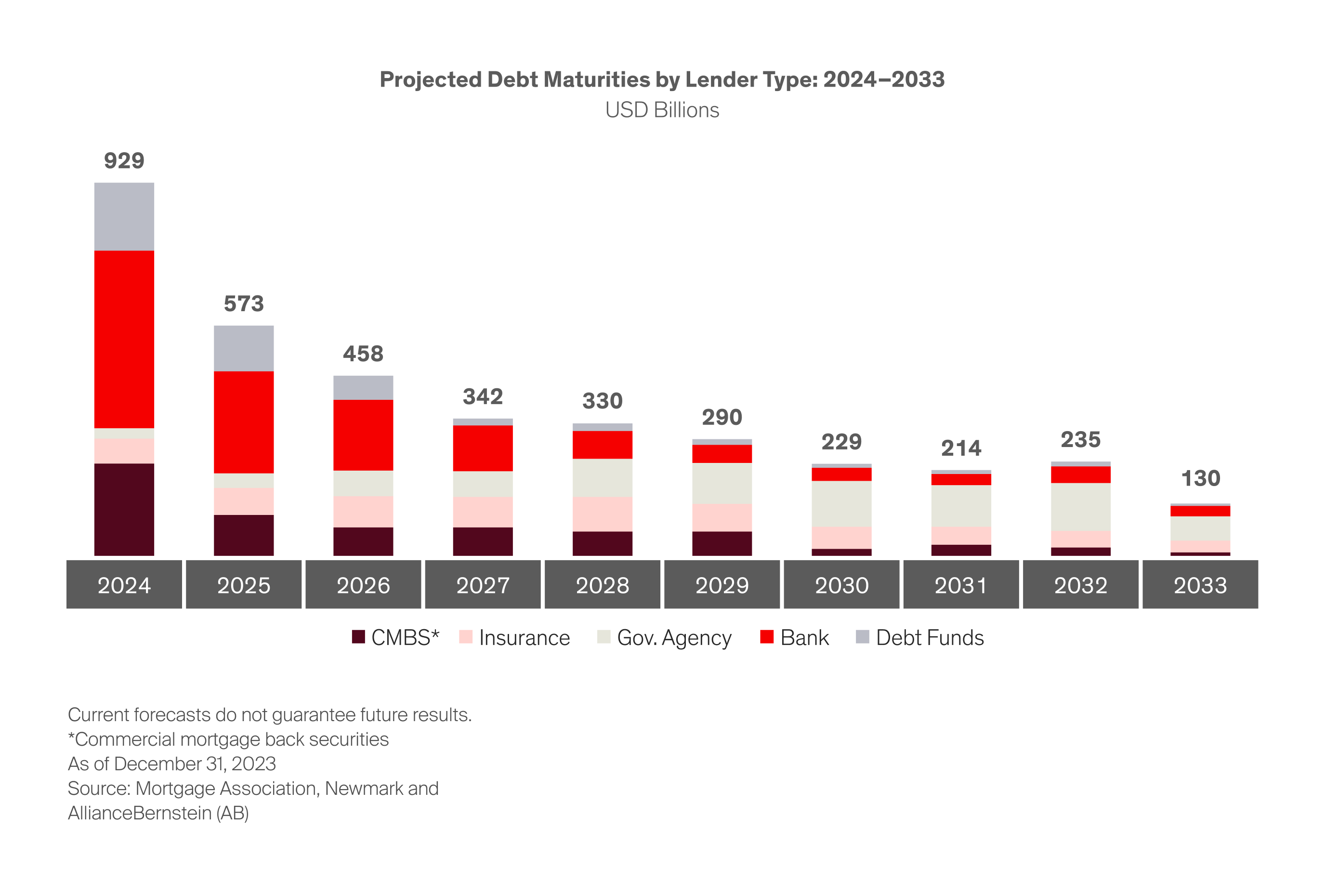

Navigating a challenging market requires a hands-on approach. Private markets are good for this type of investment. Lenders can create loans that match the current market and the needs of borrowers. These loans are based on the latest asset values, use safe loan-to-value ratios, and include protective terms. Private credit deals involve creating, negotiating, and structuring loans with regular communication between lenders, borrowers, and sometimes private equity sponsors, which helps solve issues quickly. As loans mature this year, demand for capital will likely increase, favoring lenders.

This graph shows the projected debt maturities by lender type from 2024 to 2033, measured in USD billions. The debt maturities are categorised into five types: Commercial Mortgage-Backed Securities (CMBS), Insurance, Government Agency, Bank, and Debt Funds.

What does that mean for Investors?

It means that there is strong return potential in direct lending.

At the beginning of 2024, spreads on new deals became smaller. The base interest rate for direct corporate loans is expected to be around 4.5% by the end of 2024, much higher than the below-1% rates after the financial crisis. These higher rates mean new loans will have higher returns, benefiting investors. While high rates are challenging, their stability and narrowing spreads should help increase deal volume.

Before 2008, private credit wasn’t a separate category for investing. Since then, it has grown significantly, reaching $1.6 trillion by 2023, about the size of the US high-yield bond market, with assets expected to hit $2.3 trillion by 2027, according to Preqin. Adding other forms of private credit, including commercial real estate, infrastructure, and consumer-oriented specialty finance, expands opportunities.

While high interest rates present challenges, the overall economic outlook is positive. Yields are expected to remain well above pre-pandemic levels, and the private credit market continues to expand. This is promising news for both lenders and investors.

Key Takeaways

-

The base interest rate for direct corporate loans is expected to reach 4.5% by 2024, resulting in higher investor returns. -

Private markets are ideal for active investing due to their hands-on approach, where lenders can create loans that match market and borrowers' needs. -

As loans mature, demand for capital is expected to increase, favouring lenders. -

Private credit, which was not a separate category for investing before 2008, has grown significantly, reaching $1.6 trillion by 2023.

Any questions?

Book a call with our Investor Relations team here:

If you require more information, contact us at [email protected]

Past performance is not necessarily a reliable indicator of future results.