Volatility is the new Carpe Diem for emerging markets. On Wednesday, September 18th, the U.S. Federal Reserve cut the target interest rate by a dramatic 50 basis points. Analysts warn the Fed is trying to sidestep a recession. For others, the move sent a clear message: it’s time to diversify.

When U.S. economic shifts trigger global uncertainty, savvy investors should explore opportunities beyond borders. The Middle East and North Africa (MENA) offer sound central bank management, currency stability, and a burgeoning SME sector that stands to benefit from rate reductions.

GCC Central Banks Provide Stability & Resilience

Thanks to lessons learned from the 2008 Global Financial Crisis (GFC), the Gulf Cooperation Council (GCC) central banks are well-equipped to withstand choppy global markets. During the oil boom leading up to the GFC, these nations accumulated significant reserves that allowed governments to ramp up spending and provide financial support to key sectors when the crisis hit1.

Their proactive approach helped dampen the impact of a severe economic shock.

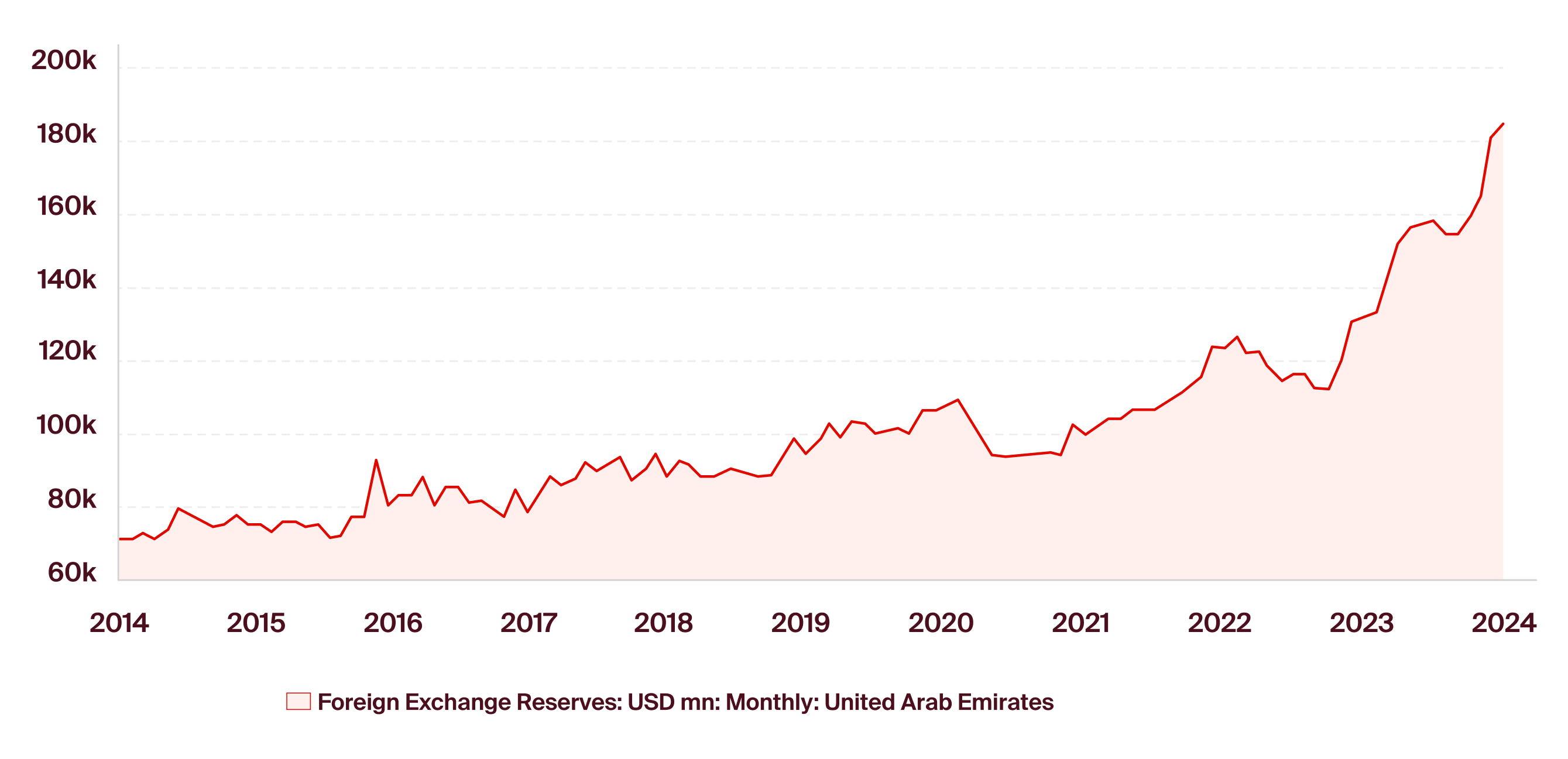

According to the U.A.E. Central Bank, the country is even more formidable today. Banking assets have swelled to AED 4.25 trillion, supported by a strong loan-to-deposit ratio of 77%2. Additionally, foreign currency reserves are at an all-time high, valued at USD $198.8 billion – 155% increase over the last ten years3.

This substantial financial buffer gives GCC central banks the capacity to sustain government spending, stimulate domestic demand, and cushion their economies against external risks like a major U.S. recession.

United Arab Emirates’s Foreign Exchange Reserves from June 2014 to April 2024

Source: www.ceicdata.com | CEIC Data

The Benefits of Falling Rates and a Weaker U.S. Dollar

Now that the Fed has slashed the rate, MENA countries with currencies pegged to the greenback could reap the rewards. A reduction in U.S. rates lowers borrowing costs for businesses across these economies. As a result, debt financing becomes cheaper for SMEs.

For those with existing loans, rate cuts allow them to refinance with lower interest expenses and more favourable terms. The knock-on effects include increased cash flow, lower risk of default, and improved creditworthiness – all of which make SMEs more attractive investment targets.

Lower interest rates could weaken the U.S. dollar, further benefiting countries with national debt denominated in U.S. dollars. As the relative value of local currencies rises, fewer units are required to repay their U.S. dollar-denominated loans, effectively lowering the cost of servicing national debt. This typically encourages further borrowing and investment, which attracts capital inflows.

When the dollar weakens, exports also become more competitively priced on the global stage, fueling economic growth overall. For the past three decades, emerging markets have seen the most substantial long-term growth during periods of a declining U.S. dollar4.

The combination of cheaper borrowing costs and a weaker dollar provides opportunities to capitalize on stable fixed-income investments within MENA. Debt-based instruments offer more predictable income streams and are less volatile than equities markets during major global downturns.

Opportunities in MENA During Global Economic Uncertainty

Despite rate hikes by GCC central banks since 2021, confidence among business owners remains high across the MENA region. A 2023 Mastercard survey revealed that 70% of SMEs are optimistic about their growth prospects over the next 12 months5.

In fact, confidence is particularly strong in Saudia Arabia, where 93% of SMEs expected growth, followed closely by Qatar and UAE5.

This optimism is driven, in large part, by governments’ strategic efforts to diversify their economies away from oil dependence. In the UAE, for example, the National SME program provides financing and mentorship, while Saudi Arabia’s Vision 2030 targets SME growth through initiatives like the Monshaat Authority and various financial programs.

Other countries, such as Bahrain and Qatar, have introduced similar measures, from grants and training to loan guarantees and startup incubators. These efforts are bearing fruit as non-oil sectors in MENA are seeing significant growth, even during a time of higher-for-longer interest rates.

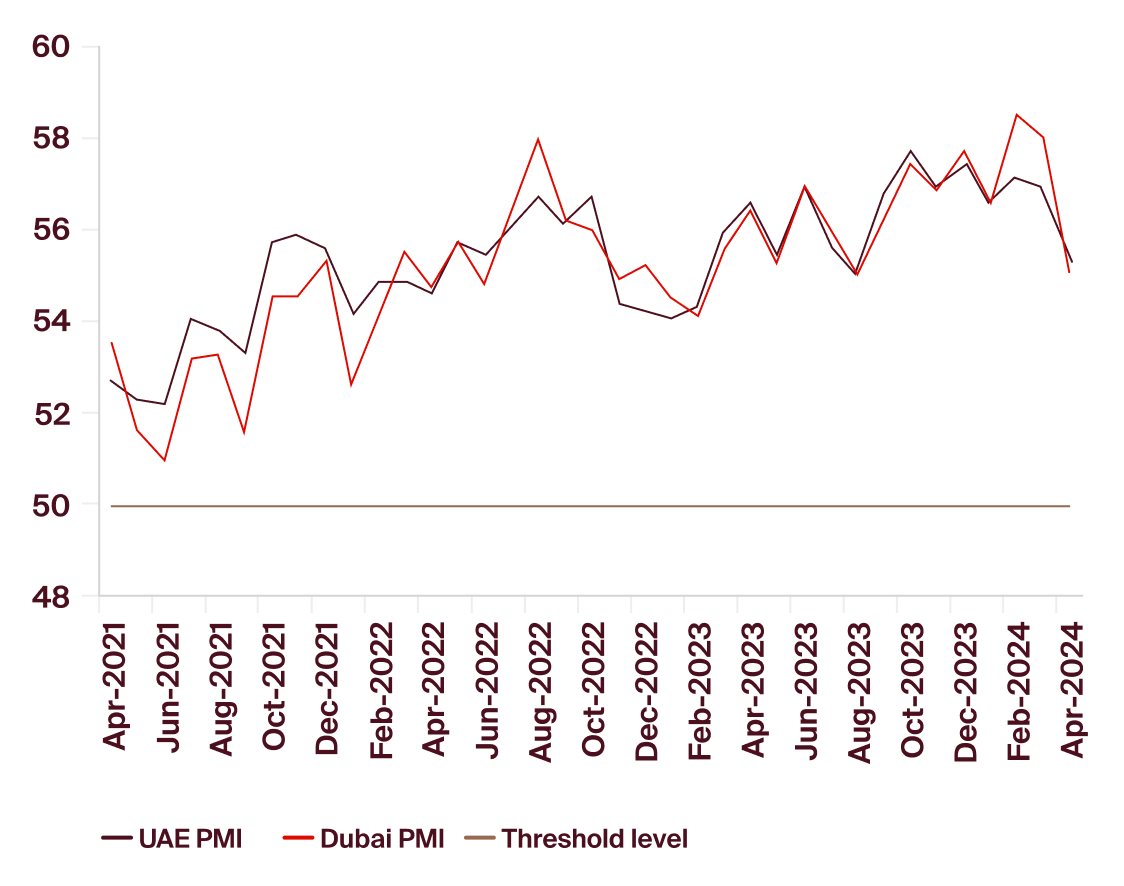

In 2023, the UAE and Saudi Arabia exceeded the International Monetary Fund’s non-oil GDP growth projections in the first two quarters, clocking in at 5.9% and 4.2%, respectively6. While things eventually cooled and stabilized, the report explained that each country’s PMI indicator “still indicates strong non-oil expansion”.

As for 2025, the U.A.E. Central Bank estimates aggressive non-oil GDP growth of 5.3%2. The region’s economic resilience offers the opportunity to invest in high-growth economies that are better insulated from global volatility.

Real GDP growth in the UAE (%)

| 2021 | 2022 | 2023 | 2024 F | 2025 F | |

|---|---|---|---|---|---|

| Overall GDP | 4.4 | 7.5 | 3.6 | 3.9 | 6.2 |

| Non - hydrocarbon GDP | 6.5 | 7.1 | 6.2 | 5.4 | 5.3 |

| Hydrocarbon GDP | -1.1 | 8.5 | -3.1 | 0.3 | 8.4 |

UAE PMI (above 50 means expansion)

P2P Lending Can Help Investors Capitalize on Global Volatility

With U.S. rate cuts and a potentially weakening dollar, MENA economies offer investors stability, resilience, and growth opportunities. Falling borrowing costs historically drive SME expansion, boosting local economies. The MENA region provides an attractive alternative for investors seeking a way to diversify away from volatile global markets.

Peer-to-peer lending platforms like Beehive, which allow direct investment in local SMEs, offer the opportunity for consistent returns with lower risk exposure. Investors can withstand economic uncertainty by capitalizing on the region’s financial strength and economic diversification while benefiting from the MENA region’s high growth potential.

Key Takeaways

-

Benefits of U.S. Rate Cuts: MENA countries with currencies pegged to the U.S. dollar stand to benefit from lower borrowing costs, making debt financing cheaper for businesses, especially SMEs. -

Export Competitiveness: As the dollar weakens, MENA exports become more competitively priced globally, fostering economic growth, especially during periods of dollar decline. -

High SME Confidence: Despite previous rate hikes, confidence among MENA SMEs remains robust, with a 2023 Mastercard survey showing 70% optimism for growth, particularly strong in Saudi Arabia (93%). -

Future Growth Projections: The U.A.E. Central Bank forecasts continued robust non-oil GDP growth of 5.3% in 2025, highlighting the region's resilience against global volatility. -

Investment Opportunities: Cheaper borrowing costs and a weaker dollar create favorable conditions for stable fixed-income investments in MENA, offering predictable income streams and less volatility compared to equities during downturns.

Any questions?

Book a call with our Investor Relations team here:

If you require more information, contact us at [email protected]

Past performance is not necessarily a reliable indicator of future results.

References

1International Monetary Fund, Impact of the Global Financial Crisis on GCC Countries and Challenges Ahead, IMF, 2010, https://www.imf.org/external/pubs/ft/dp/2010/dp1001.pdf.

2Central Bank of the UAE, Quarterly Economic Review: June 2024, https://www.centralbank.ae/media/yxlb5sot/qer_june_2024.pdf.

3CEIC Data. “United Arab Emirates Foreign Exchange Reserves.” Accessed September 19, 2024. https://www.ceicdata.com/en/indicator/united-arab-emirates/foreign-exchange-reserves.

4Pendal Group, How a Weaker US Dollar Could Benefit Emerging Markets Investors in 2023, https://www.pendalgroup.com/education-and-resources/how-a-weaker-us-dollar-could-benefit-emerging-markets-investors-in-2023.

5Mastercard, Mastercard SME Confidence Index: 72% of SMEs in MENA Project Similar or Increased Revenue in 2023, https://www.mastercard.com/news/eemea/en/newsroom/press-releases/en/2023/september/mastercard-sme-confidence-index-72-of-smes-in-mena-project-similar-or-increased-revenue-in-2023/#:~:text=In%20MENA%2C%20over%207%20out,and%20the%20UAE%20at%2074%25.

6PwC Middle East, Oil Sector Remains Robust, April 2024, https://www.pwc.com/m1/en/publications/middle-east-economy-watch/april-2024/oil-sector-remains-robust.html.