In 2016, Bkam was on the verge of dominating the price comparison space in MENA. The Egypt-based startup secured investments and expanded into promising markets like Saudi Arabia and the UAE. But when a committed investor failed to deliver $500,000 on time, the business ran out of cash and shut down. Mahmoud Abdel-Fattah, Bkam’s founder, described the experience as devastating, “It is literally like losing one of your loved ones 1.”

The problem with delayed funding

Demand for financing

Small and medium-sized enterprises (SMEs) rely on fast funding for survival and growth. A 2024 Report on Employer Firms in the U.S. found that businesses sought funding for three main reasons: operating expenses, expansion, and opportunity 2.

Yet in the Middle East and North Africa (MENA), they face staggering barriers to funding, receiving just 7% of total bank lending—the lowest in the world 3. Banks view SMEs as higher-risk and less profitable.

A study by the Shell Foundation and Citi Foundation revealed that over half of SMEs that apply for bank funding are denied, primarily due to short business histories (typically requiring 5-10 years), insufficient collateral (120%-150% of the finance value), and the absence of suitable guarantors 4.

Assessing and funding SME finance requires more time and resources, leading banks to prioritize corporates. For the few SMEs that secure finance, the interest rates range from 10%-14%, and the money often takes several months to arrive 4.

Delayed funding leaves SMEs vulnerable to a host of hidden costs, from lost opportunities to financial distress and, in Bkam’s case, total collapse.

Missed opportunities

Delayed funding can prevent businesses from seizing growth opportunities, such as expanding into new markets, landing major contracts, or the chance to secure bulk inventory at discounted rates.

A recent Pathward survey of 1,000 U.S. small businesses revealed that 27% of small businesses in the U.S. delayed planned expansions due to cash flow issues, and 25% missed growth opportunities entirely 5. In MENA, where the funding gap is among the highest in the world 6, the inability to act quickly is the difference between success and demise.

Growth stagnation

Plans to hire additional staff, purchase new equipment, and develop new products are also delayed or shelved indefinitely. Growth stagnation is particularly pronounced in MENA, where 32% of firms cite access to credit as a major constraint, compared to the global average of 26% 7.

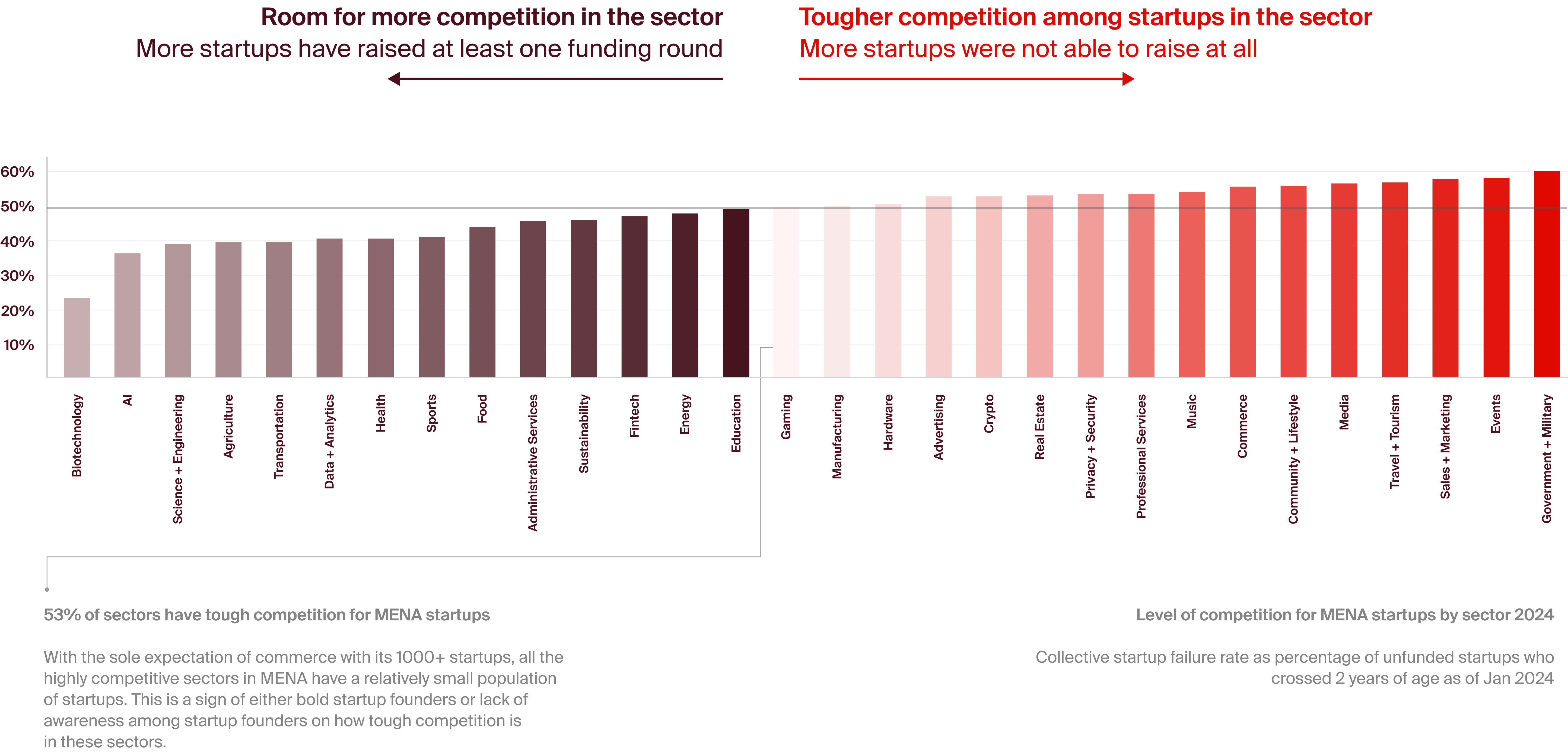

Delayed funding also prevents SMEs from establishing a competitive edge. And the more competitive the sector, the higher the death rate among nascent startups. According to a report by Clear World, unfunded tech startups in crowded industries have a failure rate of up to 60% 8.

MENA tech startup market difficulty report 2024

Operational strain

Delayed funding impacts cash flow and drives up costs in unexpected ways. Inflation can make inventory and labour more expensive over time. Supplier relationships become strained when payments are late, resulting in less favourable terms. Delayed or missed payroll can hurt morale and increase employee attrition, resulting in the loss of critical talent.

The Pathward survey also found that 77% of small businesses had just enough cash to remain operational, and 56% needed funding in the coming year, “When a company’s cash flow is under pressure, the inability to deliver on goals can be catastrophic5.”

The Beehive advantage

In the U.S., 20% of businesses fail within two years, 82% of those closures resulted from cash flow issues, while 29% run out of funds 9. The MENA region has the highest failure rates globally, at an estimated 90% 4. For SMEs caught in the cycle of delayed funding and financial exclusion, platforms like Beehive offer a much-needed alternative.

As the MENA region’s first regulated peer-to-peer lending platform, Beehive connects SMEs directly with investors. Unlike traditional bank finance with excessively slow funding timelines, Beehive offers fast, accessible, and digital funding tailored to SMEs. Finance can be fully funded in as little as 45 days.

Western Express: A success story

Western Express, a Dubai-based logistics company, struggled with cash flow issues rendering them unable to compete. The company failed to secure large contracts and competitors capitalized on their inability to expand. As a result, key customers began to slip away. Western Express soon faced an existential crisis.

With Beehive, Western Express was able to secure the necessary funds to open a new branch in Oman and take on larger contracts that had previously been out of reach. The process was fast, seamless, and avoided the burdensome collateral requirements of traditional bank finance, enabling Western Express to quickly return to profitability.

(Take a look at the full story here)

Ready to take the next step? Explore Beehive today and ensure your business has the capital it needs—when it needs it most.

Key Takeaways

-

Funding challenges for SMEs: SMEs in MENA face significant barriers to obtaining funding, receiving only 7% of total bank lending. Banks perceive SMEs as high-risk and less profitable, resulting in a high denial rate for finance applications. -

Reasons for finance denials: Common reasons for denial include short business histories, lack of sufficient collateral, and absence of suitable guarantors. This creates a cycle where SMEs struggle to secure necessary funds. -

Impact of delayed funding: Delays in funding can lead to missed growth opportunities, stunted expansion plans, and operational strain. In MENA, 32% of firms cite access to credit as a major constraint, exacerbating growth stagnation. -

Operational strain: Delayed funding affects cash flow, increases costs due to inflation, and strains supplier relationships. It can also impact employee morale, leading to higher attrition rates. -

High failure rates: The MENA region has the highest startup failure rates globally, estimated at 90%, primarily due to cash flow issues and financial exclusion.

Past performance is not necessarily a reliable indicator of future results.

References

1Menabytes. “Failed Startups: The Story of Bkam.” Menabytes. January 2019. https://www.menabytes.com/failed-startups-bkam/

2Federal Reserve Banks. “2024 Report on Employer Firms: Findings from the 2023 Small Business Credit Survey.” Federal Reserve Banks, March 2024. https://www.fedsmallbusiness.org/reports/survey/2024/2024-report-on-employer-firms

3World Economic Forum. “Scaling up SME Access to Finance in the MENA Region.” World Economic Forum. March 2019. https://www.weforum.org/stories/2019/03/scaling-up-sme-access-finance-mena-region/

4Shell Foundation. “MENA Enterprises: Challenges and Opportunities.” Shell Foundation. August 2024. https://shellfoundation.org/wp-content/uploads/2024/08/shell_foundation_mena_enterprises.pdf

5Pathward. “Small Businesses Appear Optimistic About Growth Despite Critical Challenges.” Pathward. February 2024. https://www.pathward.com/news/small-businesses-appear-optimistic-about-growth-despite-critical/

6World Bank. “Small and Medium Enterprises (SMEs) Finance: Improving SMEs’ access to finance and finding innovative solutions to unlock sources of capital.” World Bank Group. October 2019. https://www.worldbank.org/en/topic/smefinance

7Nicolas Blancher et al. “Financial Inclusion of Small and Medium-Sized Enterprises in the Middle East and Central Asia.” International Monetary Fund. 2019. https://www.imf.org/en/Publications/Departmental-Papers-Policy-Papers/Issues/2019/02/11/Financial-Inclusion-of-Small-and-Medium-Sized-Enterprises-in-the-Middle-East-and-Central-Asia-46335

8Clear World. “MENA Tech Startup Market Difficulty Report 2024.” Clear World. 2024. https://clear.world/mena-tech-startup-market-difficulty-report-2024

9Whop. “Small Business Statistics.” Whop Blog. August 2024. https://whop.com/blog/small-business-statistics/