Business

Borrow

Faster and Better

1000+

Business requests funded

15K+

Investors helping businesses

3 Billion

AED funded

Fast-track business financing

through digital SME lending

Digital SME lending is an innovative alternative finance route, using a fintech platform to simplify and speed up the process of borrowing finance. Our online platform connects your business directly with a crowd of investors on our marketplace who can fund your request in days, giving you the fast finance you need to grow your business.

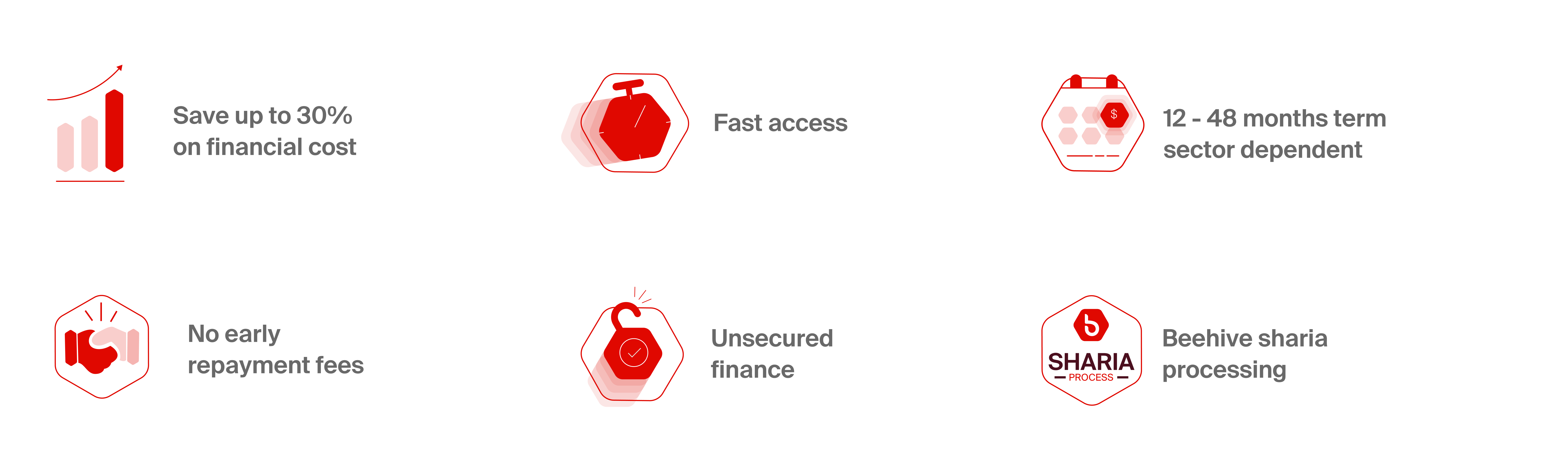

Beehive's business funding enables fast and accessible finance for your business.*

Finance amounts from AED 100 K to AED 2 M with flexible repayment terms ranging from 12 to 48 months sector dependent.

Working Capital Finance provides SMEs with short term loans, which can be accessed in hours, to quickly improve their cash flow.

Access up to 80% of outstanding invoices due within 30-120 days on Beehive and our community of investors will provide advance finance.

Find out how we helped Engage ME manage their cash flow in this case study.

What Our Customers Say About Beehive

Nathan FurlongOwner, Desert Chill

Jean-Michel GauthierCEO, Oliv

Wadih HaddadFounder & CEO, The Box Shelf Storage

David CookFounder, Project Partners

Shatha AlhashmiOwner, Babysouk.com

Mustafa Y. KoitaFounder & CEO, Koita Organic Foods

Beehive funded businesses

*Fees

Term Finance and Project Finance

-

Listing Fee: As per Request for Financing (RFF), there are some listing fees which can be paid separately or can be deducted from the financing amount. These fees cover external credit reports for reviewing and listing the RFF on the Site, as well as our processing fees. -

Additional Fees: These fees are charged upon accepting a Finance Offer and can vary depending on the financing amount. These can be paid separately or can be deducted from the financing amount. -

Borrowing fee: 3.5% of the released amount for terms of 12, 24 and 36 months.

Working Capital Financing

-

Pre-Approval Fee: These fees cover administrative fees and will be deducted from the financing amount. -

Additional Fees: These fees are charged when only when an invoice is processed and can vary depending on the invoice amount. The fees will be deducted from the agreed finance amount. -

Processing fee: 0.5% - 1.25%. -

Interest: 0.9% - 1.25% per 30 days.